Can a Taxpayer Improve Their Society Security Return?

November 01, 2025

By Marc I. Lebow, CPA, Ph.D., and Joseph E. Lebow, O.D.*

*Names listed in birth order. Marc Lebow started collecting Social Security retirement benefits in December 2025 while Joseph Lebow is eligible to collect benefits.

Accountants are uniquely qualified to provide advice to business clients about when to begin taking Social Security retirement benefits. In our previous two columns, we discussed how Social Security benefits are calculated and the Internal Rate of Return for average wage earners and high wage earners. We found, obviously, the longer one lives, the higher the return on the investment in Social Security. We also showed the Social Security formula guarantees a higher Internal Rate of Return for those who invest less in the system — although their benefits are also less. Below, we discuss some schemes and other factors that may improve our client’s return on their Social Security investment.

How does the One Big Beautiful Bill Act (OBBBA) affect Social Security and related federal income taxes?

The quick answer: The OBBBA has no direct effect on Social Security taxes. The same benefits adjusted for inflation are in effect for 2025 taxes as were in effect for tax year 2024. The key difference affecting Social Security beneficiaries is the standard deduction for those over 65 increases by $6,000 for single taxpayers and $12,000 for married filing jointly when both spouses qualify.

Without regard to the beneficiary’s total taxable income, the recipient will be taxed on no more than 85% of the Social Security retirement benefit. That means at least 15% of the benefit is received tax free. The amount of the benefits included in taxable income is dependent on taxable income and filing status. Assuming the filing status of married filing jointly, the first bracket is $32,000. If earned income and FICA benefits are above this amount, 50% of the benefits above $32,000 are included in taxable income until taxable income reaches $44,000. If earned income and benefits exceed $44,000, then 85% of the benefits are included in taxable income. For our calculations in the next section, we assume 85% of the benefit is taxed at a 32% rate.

Per these numbers and the increase in the deductions for those over age 65, the Tax Policy Institute estimates the number of Social Security recipients not paying federal income taxes will increase to 88%. This is a large percentage of elderly taxpayers. The standard deduction in 2025 is $31,500 for married filed jointly and $15,750 filing single. With the extra age deduction, the income levels exempt from taxation goes up to $43,500 for married filing jointly when both spouses qualify and $21,750 for singles and heads of household. The extra $6,000 deduction for beneficiaries over 65 starts phasing out at a 6% per dollar rate for beneficiaries with modified adjusted gross income (MAGI) exceeding $75,000 who file single or head of household and for beneficiaries having MAGI exceeding $150,000 filing married filing jointly. The additional $6,000 individual deduction for those over age 65 is currently law from 2025 through 2028.

Should the recipient take Social Security early, keep working, and invest the benefit to have a higher nest egg when they really retire?

People contemplating retirement often ask when to start collecting Social Security benefits. According to Social Security rules, each beneficiary should start collecting benefits by age 70. The earlier one elects to start collecting benefits, the lower the monthly payment but the longer the period the retiree will collect benefits before death. One argument for collecting earlier is the beneficiary may die earlier, so collecting earlier is financially beneficial. Therefore, if one plans to or has some other reason to think they will die earlier, starting to collect earlier is financially sound reasoning. A more pressing issue is many beneficiaries need additional financial support. Both these reasons support collecting the benefits earlier.

A related argument made by some who are not planning on dying earlier is the beneficiary should collect benefits at the earliest date possible, invest the retirement payments while continuing to work, and then collect on a greater nest egg when they actually reach age 70. Per this argument, the earnings from this nest egg will offset the lower Social Security payments caused by collecting earlier and foregoing the larger benefits from collecting later. Per the calculations made in our previous column, the IRR on the Social Security investment is basically between 5% and 6.5% for those who collect benefits and live past age 85. Many investors can justifiably argue they can earn much higher returns than those calculated.

Now, assume the individual earns over the maximum taxable amount for Social Security so that, at age 62 and six months, they start collecting Social Security retirement benefits. Their benefit is reduced forthe first 36 months before full retirement age, by 5/9 of 1% for each of the first 36 months of retirement before the full retirement age and 5/12 of 1% for the remaining period to full retirement age up to 60 months total. They will therefore have invested that monthly amount for eight years until age 70 — when they would have had to start collecting Social Security benefits. That nest egg must have a balance that generates enough income to cover the difference between the amount collected at age 62.5 and what would have been collected if the taxpayer had waited until 70.

Here's how it works out specifically. Using our estimates based on starting to collect in 2023, if the taxpayer had waited until 70 to start collecting, she would receive $54,660 annually instead of the $30,864 starting at age 62.5. Therefore, the nest egg must annually generate additional income of $23,796 ($54,660-$30,864) to offset lower Social Security benefits.

Starting with the $30,864 the recipient starts receiving at age 62, 85% or $26,234 ($30,864 x 0.85) is subject to income taxes. We are assuming a 32% incremental income tax rate. This marginal tax rate may be too small — most who employ a CPA for financial advice will have an incremental tax rate over this level, and we are ignoring state and, perhaps, local income taxes that will raise the incremental tax rate. But the 32% bracket covers a range from $383,901 to $487,450 (year 2024). Using this number, we can assume the recipient will be able to invest $23,796 ($30,864-(30,864 x 0.85 x 0.32)) annually.

The next issue is inflation. Predicting future inflation rates is difficult, so we assume there is either no inflation or inflation rates in increments of 1% to 4%. The rate is assumed to be constant over the period from when the individual starts collecting benefits until the age of death.

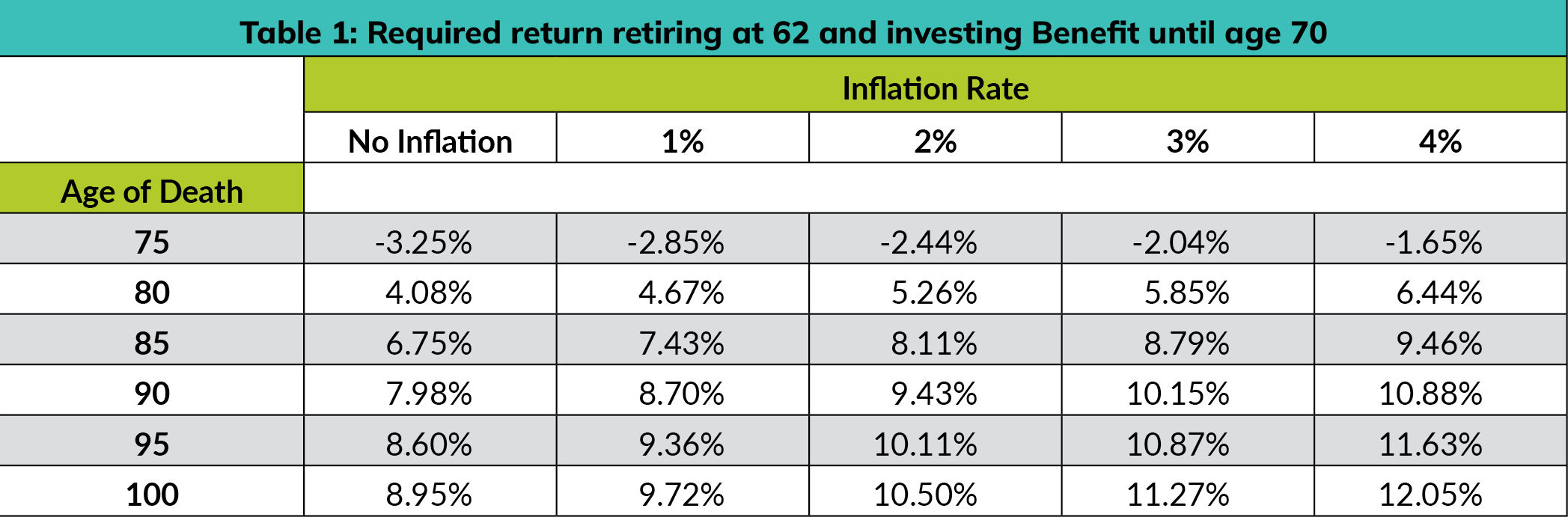

Table 1 below shows the required earnings rates over the life of the recipient based on inflation and age of death. Obviously, the longer one lives, the greater the Social Security benefit and the greater the required return. Also, the higher the inflation rate, the higher the required return. The person must decide whether they think they can equal or surpass this required return over their entire life including retirement. Related to this issue with inflation, Social Security benefits are adjusted for inflation. Therefore, the required return would have to be adjusted up to compensate for the adjustment.

There are many shortcomings to the above calculation. For example, it ignores that some of the investment may be available to heirs. Since Social Security benefits end with the death of the recipient, our calculations assume the nest eggwill be zero at death. This would be a happy coincidence. Social Security benefits are promised to last one’s full life. Also, one may outlive their savings accumulated during the working ages from when one starts collecting Social Security and reaching the mandatory age to collect Social Security (age 70). As financial advisors, we accountants should include these factors in discussion with clients.

Another more consequential issue is the Social Security Administration (SSA) does an earnings test that may reduce the retirement benefits if the recipient has earned income after they start collecting Social Security retirement benefits before reaching their full retirement age. The limitation only applies to earned income; passive income does not result in a limitation. For 2025, the earnings test is not required if the recipient has reached the full retirement age. If one is younger than the full retirement age, the limit is $23,400 for the year after which the benefit will be reduced by $1 for every $2 earned over that amount. The year the beneficiary reaches full retirement age, the limit increases to $62,160 at which the retirement benefits are reduced by only $1 for every $3 earned over that limit. The test is eliminated when one reaches full retirement age.

If the reduction for the earnings test results in the beneficiary not receiving Social Security for periods preceding their full retirement age, the benefit is adjusted so they are credited for those months. At full retirement age, the SSA recalculates and credits the beneficiary for any withheld benefits by adjusting the reduction factors used.

As a corollary to the above analysis, some taxpayers may elect to continue working after age 70. Since taxpayers are required to start collecting Social Security at 70, they will be both earning wages and collecting benefits. Depending on their total income bracket discussed above, up to 85% of their benefits will be included in taxable income. Because of the age requirement, there is little financial decision making involved in whether to start collecting the benefits.

A point sometimes emphasized when discussing working past age 70 is that the retirement benefit may increase. Remembering the formula discussed in our first column, the benefit is calculated using the average of the best 35 years of earnings adjusted (indexed) for inflation. If the earnings after age 70 fit into the top 35 years of earnings, the benefit will be adjusted upwards. But because each year worked after age 70 is only one year in a pool of 35, the adjustment to the formula will be small. If all 35 years currently included in the calculation are above the top Social Security tax bracket, there will be no adjustment. If some of the after-70 years worked are included, the effect is unlikely to be significant.

One last factor could complicate the decision process: If Social Security benefits are cut because of lack of funding, the taxpayer who starts collecting earlier and invests the additional income has a greater chance of being economically wealthier than the taxpayer who waited with the hope of collecting full benefits.

Is it beneficial for S Corporation or Limited Liability Corporation owners to move income from earned (subject to Social Security tax) to distributions (not subject to the tax?)

First, Social Security tax is applied only to earned income; passive income is not subject to the tax. In some other business forms, the owners/employees can choose how their income is classified. Prime examples include S Corporation and Limited Liability Corporations structures, which have some of the forms of a partnership and some of a corporation. The important characteristic is the owner/employee can take some income as salary (earned income) and the rest as a distribution (passive income). Distributions or dividends are not subject to Social Security taxes and are not included in the calculation of the Social Security retirement benefits.

To illustrate, assume a worker is the sole owner of an S Corporation that earns $100,000 before any consideration of the owner’s wages. In an S Corporation, the entire $100,000 flows to the owner as income, but the owner can decide whether the $100,000 is treated as passive or earned income. If the owner decides to take a wage of $100,000, Medicare (1.45%) and Social Security (6.2%) taxes are deducted. That means $7,650 (100,000 x 0.0765) is immediately deducted from wages and the S Corporation also pays $7,650 in payroll taxes matching the contribution to Social Security for the worker. The remaining $84,700 is taxed at 32%, so the owner has a tax burden of $27,104 (84,700 x 0.32) and an economic gain of $57,596 (84,700-27,104).

Continuing the example, the owner/worker could decide to take all the earnings as a distribution and report no earned income. This will eliminate the Social Security amounts paid by the wage earner and the S Corporation’s matching payroll tax expense. The full $100,000 would be taxed at 32% resulting in a $32,000 tax expense and the owner will have netted $68,000. By declaring all income as a distribution and none as earned income, the owner will be economically wealthier by $10,404 (68,000-57,596).

Workers who have already vested into Social Security enough to receive a minimum Social Security benefit may improve their return by keeping wages lower so theirPrimary Insurance Amount (PIA) benefit comes from the lower bracket of 90%. This means having annual income closer to $12,288 (1024 x 12). The benefit will be lower, but if the income not taxed by Social Security is invested in retirement accounts, the overall retirement income is likely to be higher.

The IRS recognizes the problem of individuals classifying earned income as a distribution that is not subject to the Social Security taxes instead of earned income subject to the tax. IRS instructions to taxpayers in this situation (in Form 1120-S, U.S. Income Tax Return for an S Corporation) read in part:

"Distributions and other payments by an S corporation to a corporate officer must be treated as wages to the extent the amounts are reasonable compensation for services rendered to the corporation.”

Accordingly, if audited, the IRS is very likely to penalize the taxpayer who adopts this scheme. No calculations were made to assess whether the benefits of this scheme compared to the risk of being caught and penalized is worthwhile.

So, is Social Security a good investment?

For many workers, Social Security retirement benefits are a good investment — while for others, the answer is no. From a financial perspective, the numbers indicate that the lower one’s contributions into Social Security, the better one’s financial return despite the lower the dollar amount of benefits received. Accordingly, vesting for Social Security benefits requires 40 quarters (10) years of contributions. Once that standard is met, any additional contribution will increase one’s benefit but the Internal Rate of Return on one’s investment will be lower. This means someone may earn more by investing their money in other retirement plans than the return provided by Social Security. But, many people have difficulty saving money. For these people, Social Security is a greater part of their retirement portfolio. Also, Social Security is sold to the public as guaranteed while no private retirement plan can make that claim.

Depending on a worker’s investment skills, life expectancy, and economic needs, taking Social Security early and investing the benefits to build a nest egg may be economically beneficial — although the longer the beneficiary lives and the higher inflation the levels over the time period, the more difficult it will be to become economically wealthier.

Schemes to increase the return for the Social Security retirement benefits by converting earned income into distributions have financial merit but also carry legal risks. Reclassifying income from earned income subject to Social Security taxes to passive income not subject to those taxes may increase one’s internal rate of return on their Social Security investment but could increase the risk of an IRS audit and greatly increase the risk of being found guilty of tax fraud.

Several relevant issues are continually mentioned but not addressed. The most relevant is that the Social Security benefit fund is being drained by current retirees and there are too few current workers contributing to the funds to maintain current benefits. Social Security benefit statements contain a warning that unless new funding sources are approved by Congress, only a fraction (70%) of benefits may be paid in the future. Obviously, this will be harmful to those relying on these benefits.

The question of whether Social Security retirement benefits are a good return is also partly dependent on someone’s attitude toward Social Security and their life situation. For example, if one is forced to retire before age 70 without significant savings available, taking Social Security early is not a choice. If one is qualified to collect Social Security retirement benefits and is still working but is not earning enough to support one’s lifestyle, or if one believes their life expectancy is low, taking Social Security retirement is not a decision but a necessity.

We have tried to address some financial decisions concerning Social Security using financial models and a decision aid. Obviously, everyone has to make their own decision based on their own circumstances but these models may aid in the decision process.

Marc Lebow, CPA, Ph.D., has been a teacher in the Hampton University Accounting Department since 1995. Before earning his Ph.D., Marc worked in public accounting for three years and for the Virginia Auditor of Public Accounts for three years.

Joseph E. Lebow, O.D., is president of Lebow Eye Associates, PC, and practices optometry with offices in Hopewell and Chesterfield. He graduated from the Southern College of Optometry in Memphis after attending Virgnia Tech. Turning 62 this year and becoming eligible for Social Security benefits puts him in the middle of this complex decision-making process.