A New Era of CPA Licenses: Alternative Pathway and CPA Evolution

November 01, 2025

By Ning Zhou, CPA

Over the past year, the 150‑hour educational requirement and the alternative pathway to CPA licensure have become prominent topics among accounting practitioners and academics. This conversation started among states and with the 2024 exposure draft of the Uniform Accountancy Act (UAA) proposed by AICPA and NASBA1 and concluded with the release of the final 9th Edition of the UAA in July 2025. Under the new framework, the traditional master’s degree plus 30 hours pathway remains intact, while the alternative pathway offers an additional route to licensure by completing two years of work experience. Following this proposal, the Virginia General Assembly enacted legislation to expand access to the CPA licensure pathway, effective Jan. 1, 2026. Virginia thus became the second state, after Ohio, to adopt this alternative pathway.

This article outlines the structure of the alternative pathway and discusses its advantages and challenges, drawing insights from industry professionals and academic experts. It also provides an overview of ongoing alternative pathway adoption efforts across the United States. Finally, it examines the impact of CPA Evolution on CPA Exam pass rates over the past year.

CPA alternative pathway

Historically, Florida’s 1983 mandate for 150 credit hours established the national standard. Under this framework, there are multiple paths to reach 150 hours of education: many students pursue a master’s degree in accounting or business or an MBA; others build expertise by obtaining graduate certificates; and some double major in an undergraduate program and take additional coursework to accumulate the required credits. While these options vary in cost and structure, the 150-hour requirement has driven rising education costs and, over time, has coincided with (and perhaps contributed to) a decline in minority CPA candidates (~26%), prompting consideration of reform.2,3

In the 2024 exposure draft of the Uniform Accountancy Act (UAA), AICPA and NASBA proposed an alternative pathway allowing bachelor’s degree candidates to bypass the 30 additional credit hours by demonstrating a set of professional and technical competencies certified by experienced CPAs.1 This competency-based model sought to replace coursework with experiential learning, but it was not adopted after stakeholder concerns about consistency and the difficulty of standardizing evaluations across states. Instead, the final 9th Edition of the UAA (July 2025) introduced a simpler option: candidates with a bachelor’s degree in accounting can earn licensure by passing the CPA Exam and completing two years of work experience verified by a CPA licensee.4

Alternative pathway benefits and drawbacks

Industry and academic perspectives have identified these benefits of the new pathway:

- Lower financial burden: Replacing 30 additional credit hours with a second year of paid work experience can save students roughly $25,000 in tuition and fees.5 This supports efforts to attract prospective accounting students and mitigate pipeline challenges.

- Shorter time to licensure: The pathway enables graduates to enter the workforce sooner by completing a four-year bachelor’s program instead of a five-year, 150-hour track. This reduction in time to licensure helps alleviate both financial strain and the accountant-shortage issue.

- Greater flexibility and accessibility: The pathway offers an attractive route for non-traditional students, community-college students, and those from socio-economically disadvantaged backgrounds who face time or cost barriers.6

- Alignment with market demand: Public endorsements from major firms (e.g., KPMG, Deloitte, EY, PwC) for the 120-hour plus experience model suggest the pathway could address the accounting talent shortage.5

- Maintains mobility and interstate reciprocity: NASBA/AICPA envision the pathway preserving interstate consistency, reducing the risk of a patchwork regulatory landscape.5

- Perceived value of experience: Many practitioners believe on-the-job learning can be more relevant to professional practice than an additional academic year.

Drawbacks of the pathway include:

- Risk of lower professional quality: Reducing 30 credit hours of structured education may diminish analytical depth, technical breadth, and public-protection safeguards.7

- Firms are not educators: Accounting firms typically lack accreditation, faculty expertise, and pedagogical resources; replacing universities with firms risks blurring the line between education and training. 7

- Uncertainty for master’s degree programs: Broad adoption could reduce Master’s of Accounting enrollments, threaten faculty positions, and shrink advanced curricula. For example, a recent AACSB survey of accounting department chairs indicates concern that new pathway adoption may reduce enrollments in master’s programs.

- Persistent transfer penalties for community-college credit: Even with the 120-hour option, inconsistent articulation policies between two-year and four-year institutions can impose additional costs and credit loss.6

Status of different states

Across the United States, credentialing trends are evolving, and licensing jurisdictions vary in how they approach CPA licensure. Dozens of state CPA associations and Boards of Accountancy are actively discussing how licensure requirements may affect the accounting talent pipeline. These conversations are moving at different paces and across jurisdictions. NASBA maintains a consolidated resource that tracks jurisdictions that have enacted new licensure pathways, including the new pathway.

CPA Evolution pass rates

Beyond the CPA alternative pathway, the CPA Exam underwent a major reform under CPA Evolution, effective in 2024. This change is widely regarded as one of the most significant shifts in a decade for the CPA Exam. The Exam maintains the three core disciplines — Financial Accounting and Reporting (FAR), Audit and Attestation (AUD), and Regulation (REG) — while replacing Business Environment and Concepts (BEC) with three new sections: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Transaction Processing and Controls (TCP).

Figure 1 displays the pass rates of the three core sections (FAR, AUD and REG) in the last seven years.8

- AUD: The AUD pass rate gradually declined from a peak of 52.84% in 2020 to 43.54% in Q4 2024, then recovered to 49.05% in Q2 2025.

- FAR: FAR followed a similar pattern, dropping from a high of 49.98% in 2020 to 36.80% in Q4 2024, with a strong rebound to 43.52% in Q2 2025.

- REG: REG remains the strongest among the core sections, consistently around the 60% range, with continued stability in 2025.

Fig 1. Pass rates of FAR, AUD and REG from 2019 to 2025’Q2.

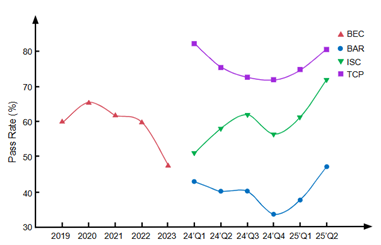

Figure 2 displays the pass rates of the three new sections, BAR, ISC and TCP).9

TCP: TCP sits atop the new sections, dipping to 72.16% in Q4 2024 and rebounding to 80.63% in Q2 2025, near its early-2024 peak.

BAR: BAR sits near the lower end, decreasing from 42.94% in Q1 2024 to 33.68% in Q4 2024, then rising to 47.26% in Q2 2025 — slightly above its starting point.

ISC: ISC shows the most notable improvement. After beginning at 50.93% in Q1 2024, ISC rose markedly through 2024, with a strong gain into 2025, ultimately rising 21 points above its starting point to 71.96% in Q2 2025 (about 21 percentage points above its starting point).

Fig 2. Pass rates of BEC, BAR, ISC and TCP from 2019 to 2025’Q2.

Viewed together, the six sections show a meaningful upward trend in 2025. Several factors likely contributed to this improvement. First, the January 2024 CPA Exam Blueprint provided a framework that gave accounting programs time to realign curricula and introduce updated or new courses and track-specific offerings; many programs implemented changes as early as fall 2024, positioning students for better outcomes in 2025. Second, a May 2025 AACSB survey of accounting department chairs indicated that more than 84% of respondents felt their curricula were effectively preparing students for the new Exam, suggesting greater alignment between education and the evolved test. Third, the availability of year-round data from preparation providers enabled refinements in training materials and practice items, helping candidates become more proficient with the new format — particularly in the newer sections BAR, ISC, and TCP. Collectively, these dynamics appear to have contributed to the observed performance gains in 2025.

Conclusion

The new CPA pathway and CPA Evolution mark a pivotal shift in licensure and professional preparation. By allowing a competency-based route alongside traditional education, the profession seeks to broaden access, reduce time to licensure, and better meet market needs, whilst still preserving public protection. The pathway’s benefits — reduced educational barriers, lower costs, and quicker entry into the profession — must be balanced against the requirement for additional work experience and the continued need to uphold rigorous professional standards. States continue to adopt these changes, with several jurisdictions having already implemented the framework, and others having evaluated its implications for Master of Accounting programs and workforce pipelines.

As stakeholders — including firms, academic institutions, and regulators — monitor outcomes, ongoing dialogue and robust evaluation will be essential to ensure the alternative pathway enhances the profession without compromising quality and public trust.

Ning Zhou, CPA, is an instructor in accounting at the University of Virginia’s College at Wise and a Ph.D. candidate at the University of Scranton.

- AICPA & CIMA. Exposure draft: Proposed “CPA Competency-Based Experience Pathway”. Sept. 12, 2024.

- Edmonds, J. Is 150 too many? May 10, 2023.

- Miller, W. F., Mintz, S. M., & Shawver, T. J. NASBA and the AICPA Propose an Alternative Path to CPA. CPA Journal, 94. 2024.

- AICPA & CIMA. Uniform Accountancy Act: Ninth Edition. July 17, 2025.

- Dawkins, M. C., Dugan, M. T., & Muriel, L. Pipeline Impacts of the Proposed CPA Competency-Based Experience Pathway. CPA Journal, 94. 2024.

- Dorata, N. T., Shea, V. J., & Ulrich, M. M. The Plight of the Community College Graduate Entering the CPA Pipeline. CPA Journal, 94. 2024.

- Tucci, A. J. Navigating the Accounting Pipeline Crisis. CPA Journal, 94. 2024.

- SURGENT. CPA Exam pass rates. July 2025.

- AICPA & CIMA. Learn more about CPA Exam scoring and pass rates. April 17, 2025.

- NASBA. New Licensure Pathways. Aug. 22, 2025.