A VSCPA member finds 199A to be a complicated solution to reduce income taxes on certain taxpayers.

By Gary Dittmer, CPA

The Tax Cuts and Jobs Act of 2017 created Internal Revenue Code Section 199A , which represents Congressional intent to reduce income taxes on trade or business income from passthrough entities, including sole proprietorships, in light of the reduction of the corporate tax rate from a maximum progressive rate of 35 percent to a flat or proportional rate of 21 percent. (Due to double taxation, corporate earnings are still taxed at a combined rate of 36.8 percent, assuming all after-tax earnings are distributed as qualified dividends.)

While the intention of 199A is commendable, the execution is the opposite. Section 199A introduces new definitions, computations, a phase-in of limitations and no deduction for professionals other than for architects and engineers earning more than $421,400 if their filing status is married filing jointly or $210,700 in 2019 for any other filing status. These amounts will be adjusted for inflation annually.

Section 199A violates at least two of Adam Smith’s maxims of taxation in his landmark book, “An Inquiry Into the Wealth of Nations, Volume II”: certainty and ease of collection. Certainty refers to the ability of taxpayers to determine their tax liability within a reasonable degree of confidence, while ease of collection relates to the cost-benefit of collecting a tax. That is, it should not be excessively costly to verify a taxpayer’s self-determination of tax.

In designing this system, Congress had two choices. The first is a relatively simple solution and the second is the opposite:

- Create a separate tax rate for qualified business income as was done for capital gains and qualified dividend income, or

- Create a deduction to reduce taxable income for a qualified business that indirectly reduces the effective tax rate.

Unfortunately, Congress chose the deduction method, which includes new definitions, complex computations and deduction limitations that either phase in or completely eliminate the benefit of a lower effective tax rate.

At taxable income levels below $321,400, if married filing a joint return (MFJ) or $160,700 for all others, the deduction is fairly straightforward: compute 20 percent of qualified business income (a new definition) not to exceed a maximum of 20 percent of modified taxable income (also a new definition). The maximum effective tax rate for a qualified trade or business income (QBI) at these income levels is 29.6 percent, computed as follows: with a 20 percent deduction, 80 percent of income will be subject to tax. Therefore, 80 percent (100 percent minus 20 percent) of the maximum individual tax rate of 37 percent is the effective rate of 29.6 percent.

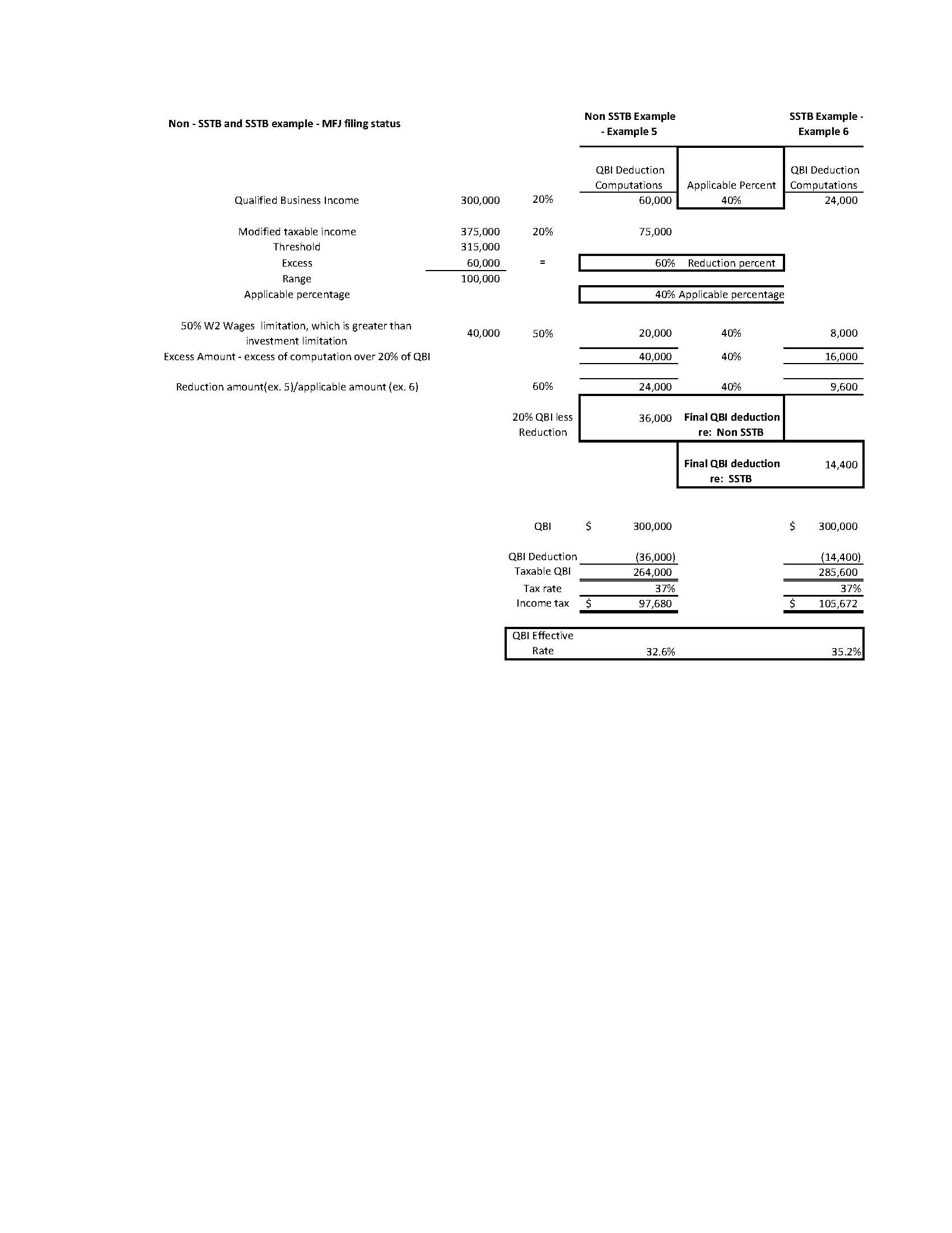

Once taxable income is within the limitation phase-in range of $321,400 to $421,400, the computation is more challenging, and depends on whether the taxpayer is a professional in a specified services trade or business (SSTB: another new definition). Essentially, an SSTB is any professional other than an architect or engineer. Here is a comparison of the deduction for taxpayers within the phase-in range between an SSTB (example 6) and a non-SSTB (example 5). These examples are from Regs. 1.199A — 1(d)(4) Examples 5 & 6.

In this example, the taxpayer’s taxable income and modified taxable income are the same ($375,000), while the QBI is $300,000 from an S Corporation. The S shareholder is not an SSTB in example 5 but is in example 6. The excess of taxable income over the threshold amount is $60,000, which makes the reduction percentage 60 percent and the applicable percentage is the inverse, 40 percent. For those interested in the details, I show the detailed computation step by step at the end of this article.

The effective tax rates are 32.6 percent for the non-SSTB professional (an architect), and 35.2 percent for the SSTB taxpayer (a CPA). In addition to the complexity of computing both the phase in for the non-SSTB example and phase out in applying the applicable percent, what logic could possibly justify the difference in treatment for these two professionals — a better lobbyist? Could it be an incentive for production-based professionals whose work yields tangible property as opposed to intangible property? Perhaps, but the distinction appears arbitrary and capricious.

I suggest Congress should repeal and replace Section 199A to a tax rate computation like net capital gains and qualified dividends, which is much simpler and easier to compute and audit, and eliminate SSTB status. Neither method is perfect, but I believe Congress should be required to consider a straightforward approach over a more complex method to achieve a tax policy goal. By incorporating a succinct intent or principle within the Code when drafting new tax legislation that simplifies deductions, credits or computations of taxable income, tax policy can be efficiently and cost effectively enforced and adhere more closely to Adam Smith’s maxims of taxation.

Breaking news: IRS released Revenue Procedure 2019-35 on Sept. 24, 2019, that specifies criteria for a safe harbor for real estate investments to be treated as a qualified trade or business.

Gary Dittmer, CPA, CMA, CGMA, retired as senior tax director for Spok, Inc., in Springfield. He is an adjunct professor at George Mason University and the University of Virginia School of Continuing and Professional Studies, where he teaches taxation. Contact him at gdittmer at comcast.net.

EXHIBIT 1: Non-SSTB versus an SSTB