Across the country, states and localities are addressing population and migration shifts by offering relocation incentives.

By Joshua J. Malancuk, CPA, CMI

Remote workers and others looking for a change of urban scenery are tapping into newly created state and city relocation incentives. The Census Bureau’s 2021 American Survey, released in 2023, indicates the number of people working from home tripled between 2019 and 2021 thanks to the pandemic, now accounting for almost one in five (18%) U.S. workers. By 2025, nearly one in four (22%) Americans will be working remotely, according to Upwork data. This suggests a continuous, yet gradual, shift toward remote work arrangements, and the pandemic accelerated the migration of remote workers to the nation’s southern and western regions.

In response to these workforce trends, state and local economic development planners have shifted their longstanding strategies for motivating business job creation by coupling their employer incentives with individual relocation incentives to attract qualified workers, including remote worker residency. Work-from-homers and others seeking change are taking advantage of newly created state and city relocation incentives that typically include cash grants and/or tax moratoriums for relocating.

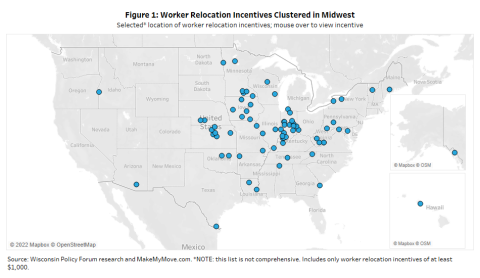

This trend has accelerated since the pandemic thanks in part to MakeMyMove.com, an online marketplace for remote workers to browse communities willing to provide incentives to relocate. It may come as no surprise that the majority of U.S. relocation incentive programs are offered by midwestern states, especially in my home state of Indiana, where at least 16 communities or groups of communities have program offerings.

In partnership with Indiana Economic Development Corporation (IEDC), MakeMyMove.com is incentivizing out-of-state families to move to Indiana communities that participate in the program. Eligible workers could be any individual who moved to Indiana since Jan. 1, 2022, and who is a full-time employee of a business outside Indiana who performs most of his or her employment duties remotely. A remote worker would be eligible for a grant of up to $5,000 per year capped at $15,000 over the incentive term. Local and regional relocation incentives are also available.

At least two dozen other municipalities across the U.S. will pay workers as much as $20,000 to relocate there. According to Flexjobs, Alabama, Oklahoma, Georgia and West Virginia have been especially aggressive in recruiting individuals with remote jobs using some attractive incentives.

While no Virginia communities are listed on the site, West Virginia communities of the eastern panhandle, Greenbrier Valley and Morgantown all offer incentives.

At the city level, the Tulsa (Oklahoma) Remote program offers a $10,000 grant to non-Oklahoma residents working remotely for companies based outside the state who agree to relocate and live in the city for at least one year. More than 2,000 workers have moved to Tulsa already through this program, which also provides free membership at a downtown Tulsa co-working space thanks to funding from the Kaiser Family Foundation. Other cities and states looking to attract remote workers include:

- Greensburg, Ind.: Offering $5,000 to newcomers.

- Lewisburg, W.Va.: Total incentive value = $20,000.

- Stillwater, Okla.: Total incentive value = $7,500.

- Augusta, Maine: Total incentive value = $15,660.

- Montpelier, Vt.: Total incentive value = $15,000.

- Rutherford County, Tenn.: Total incentive value = $10,000.

- Honolulu, Hawaii: Total incentive value = $2,500.

- Juneau, Alaska: Total incentive = $3,000.

Working from home is a trend that states see as opportunities for growing local economies with building residency of these workers. It’s important that you and your clients understand how various states are also competing with other states for residency of remote workers and for other onsite workers by offering material incentive programs that will likely lead to enhanced economic growth.

Supporting company business growth via hiring incentives is another strategy to help you and your clients build local and state economies. These incentives allow states to compete for business expansion projects by offering employer incentives that help reduce a company’s short-term hiring costs. Stay tuned; further discussion about this important growth tool will be presented in an article in the winter issue of Disclosures.

Josh Malancuk, CPA, CMI, is president of JM Tax Advocates, a service organization that advocates for property tax reductions and maximum level incentives for leading U.S. manufacturers and commercial property owners. He brings 28 years of specialized knowledge and experience to his clients. Contact him at (317) 674-8390 x100.