By Abi Joshi, CPA

Tax Director, PricewaterhouseCoopers, McLean

Without any doubt, it is fair to say that Sovereign Wealth Funds (SWF) play a vital role in the generation of wealth, employment, value creation and overall sustainability of a global economy. SWFs are investment arms of any sovereign nations responsible for managing and investing nation’s wealth in domestic and international markets. Their sole purpose is to diversify the excess cash resulting from trade surplus generated by the government in the hope of getting higher returns on investments. We hear in the news so many SWFs making megadeals in various continents of the world. For example, back in 2015, Qatar Investment Authority committed to make roughly $35 billion dollar in U.S. focusing on technology, energy and real estate over the span of five years. Every major multinational company and private equity fund in the world has major backings from these SWFs. According to Sovereign Wealth Fund institute, Government Pension Fund of Norway, China Investment Corporation and Abu Dhabi Investment Authority are the top three listed SWFs in the world with their total combined assets in excess of $2 trillion.

There is a key difference between SWFs and funds held by nations’ central banks. While a sovereign wealth fund is an investment pool of foreign currency reserve owned by a government to make investments for high rate of return, funds held by state-owned companies and government employee pension funds have different goals — to manage the value of its currency, to stimulate the economy or prevent inflation (1).

Foreign direct investment from SWFs in the United States can be considered as a major source of cash flow in the U.S. economy, and to ensure that smooth flow of cash, U.S. Internal Revenue Code (IRC) Section 892 is a special rule within internal revenue code which allows a tax exemption to the foreign government in making investment in the United States, with certain caveats. Some of those investments covered by Sec. 892 are interests, dividends and gains arising from stocks, bonds, securities, bank deposits, etc. As a general rule, foreign persons are generally subject to a 30 percent U.S. withholding tax on U.S.-sourced dividends unless there is a treaty benefit. Section 892 exempts SWFs from this type of withholding tax. Similarly, if any foreign person owns greater than a 10 percent vote or value in any corporation, interest income from such source would be subject to a 30 percent withholding tax unless there is a treaty benefit which would reduce the rate. There is a special provision in the law called portfolio interest exception that as long as an investor owns less than a 10 percent vote or value in the borrower, the investor is not subject to withholding tax on the interest income. However, Sec. 892 exempts a foreign government from the 30 percent withholding tax on all interest from non-controlled borrowers that doesn’t otherwise satisfy the portfolio interest exception. In addition, even though the SWF of a particular nation may not have a bilateral tax treaty with the U.S. government, earnings from certain non-commercially motivated investments (primarily debt and equity investments) are still tax exempt due to Sec. 892 exemption. For example, Middle Eastern countries such as the United Arab Emirates, Qatar, Bahrain, etc. do not have tax treaties with the United States, and if the foreign investor (other than SWFs) from those nations were to lend greater than a 10 percent stake in the US company, their interest income would be subject to a 30 percent withholding tax.

Although Sec. 892 is a special mechanism by which SWFs get tax-free treatment in the United States, there are certain caveats that disallow such an exemption. Any income derived by SWFs from the conducting of commercial activity (with the exception of trading or investment exceptions), income received by directly or indirectly from a “commercially controlled entity” and any gain derived from the disposition of any interest in a commercially controlled entity are not exempt from Sec. 892.

A commercially controlled entity can be defined as any separate entity (Corporation or Partnership) engaged in the commercial activity in any part of the world in which s foreign government holds, directly or indirectly, greater than a 50 percent vote or value or any interest that would mean an effective control of such entity. Any income generated in the United States by such a commercially controlled entity loses Sec. 892 exemption for the foreign government or SWF and is subject to regular income tax. For example, let’s say a foreign government which doesn’t have a tax treaty with the United States directly owns 60 percent interest in a U.S. corporation engaged in trade or business, and its share of dividend income is $100, it is not exempt from Sec. 892 and subject to the full withholding tax of 30 percent. It is also important to note that since there is no U.S. tax treaty with the country in which foreign government operates, it cannot get the reduced tax treaty benefit. Similarly, let’s say that the above mentioned foreign government also separately owns less than a 50 percent vote or value of a stock of a US multinational company, its share of income derived from such company is not taxable due to the Sec. 892 exemption because foreign government is not considered in commercial activity due to investment exceptions (e.g. where less than 50 percent investment in stocks, bonds and loans, etc. are not considered as not considered as commercial activity).

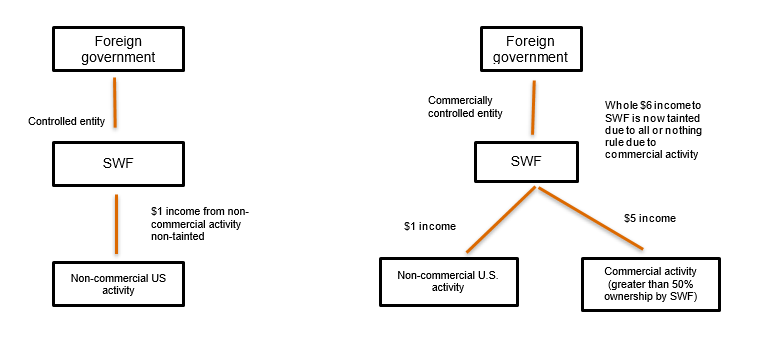

However, it is key to distinguish between a “commercially controlled entity” and “controlled entity”. While SWFs are controlled entity of a foreign government, not all investments made by SWFs are necessarily through commercially controlled entities. As mentioned in examples above, if a foreign government engages in a commercial activity, only that income is tainted from Sec. 892 exemption, but not from other investments where the foreign government in not involved in commercial activity. However, under the all-or-nothing rule, if a “controlled entity” engages in any commercial activity and earns only $1 income from specific activity, it will lose the entire benefit of Sec. 892 exemption not only on that $1 income, but also on its entire portfolio of other income (from other non-commercial activity) because that SWF is now considered as “controlled commercial entity” of a foreign government. This can be a huge challenge and trap for unwary foreign governments and SWFs as they start making investments in the United States without proper tax planning and due diligence. Therefore, any time SWFs want to participate in commercial activity in the U.S or anywhere else in the world beyond being involved in non-commercial activities, it is important to have proper tax planning and due diligence done to avoid tripping into unfavorable circumstances which would preclude them from Sec. 892 exemptions in the United States.

Disclaimer: This article is my personal view only and not to be taken as tax advice.

(1) https://www.reuters.com/article/us-gulf-qatar-qia/qatar-sovereign-fund-…

(2) https://www.thebalance.com/sovereign-wealth-funds-3305969