By Jill Edmonds

Data analytics, artificial intelligence, virtual workspaces, remote learning … The professional life of a CPA is a far cry from the physical general ledgers of the past. The skills and competencies CPAs need today to continue to provide high-level services to their companies and clients are rapidly changing.

Not only that, it’s difficult to keep up with the current accounting body of knowledge. Compared to 1980, there are:

- Three times as many pages in the U.S. Internal Revenue Code.

- Four times as many accounting standards.

- Five times as many auditing standards.

It’s enough to make anyone’s head spin. To ensure compliance, companies are turning more and more to technology and information systems — and relying on CPAs to show deeper skills like critical thinking, professional judgment/skepticism, data management and much more.

The profession responds

To ensure the CPA designation remains relevant in this changing landscape, the American Institute of CPAs (AICPA) and National Association of State Boards of Accountancy (NASBA) spent three years gathering information on how best to transform licensure for the future. The resulting CPA Evolution initiative includes input from more than 3,000 stakeholders, including state CPA societies, firms, colleges and universities, students and others.

According to the AICPA, the No. 1 comment received was support for the need to change the path to licensure. Respondents asked for a greater emphasis on technological skills as a licensure prerequisite.

In the fall of 2019, the AICPA and NASBA reviewed feedback and considered multiple options before releasing a recommended new licensure model.

The future CPA Exam

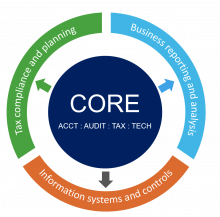

The new licensure model includes a core of accounting, audit, tax and technology, and then three disciplines: tax compliance and planning, business reporting and analytics and information system and controls (see below).

Every candidate will have to pass the same core, but then individually choose one discipline in which to demonstrate deeper skills. The Exam will still consist of four sections: three for the core and one for the chosen discipline. It is not planned to take more than the current 16 hours.

Ultimately, the allocation of content of the core and disciplines will be determined by revisions to the education requirements of state boards of accountancy and through a CPA Exam practice analysis.

The disciplines will not pigeonhole a candidate into a certain career track, however. Candidates are not limited to practicing in that one area; the discipline is just an opportunity to demonstrate deeper skills and knowledge.

The model is designed to reflect the current reality of practicing as a CPA, be adaptive and flexible and enhance public protection, and is expected to launch in January 2024.

The VSCPA’s involvement

As part of the input process with the AICPA and NASBA, VSCPA leaders and staff provided input at various parts of the CPA Evolution process. On April 29, 2020, the VSCPA Board of Directors voted to support the Initiative and issued a resolution, which you can find online at vscpa.com/evolution-resolution.

"The business environment is rapidly changing, and it has become clear to the CPA profession as a whole that the requirements for licensure need to evolve to meet the demands of this new reality," said VSCPA President & CEO Stephanie Peters, CAE. "The VSCPA Board discussed the CPA education, experience and exam requirements at length and ultimately determined to support the initiative of the AICPA and NASBA, which allows CPA candidates to continue to receive the accounting and taxation skills they need but also focus on information systems and controls if they choose."

Approval and implementation

In May 2020, AICPA Council voted to advance CPA Evolution and the NASBA Board of Directors followed suit in July. NASBA also issued an exposure draft over the summer to change the Uniform Accountancy Act (UAA) Model Rules in support of CPA Evolution (the comment period ended Aug. 31).

Now, to make the new licensure model a reality, NASBA will encourage state boards of accountancy to implement any model statutory and rule changes in education necessary. The UAA is a model act and rules, however, that are intended to be a guide and is not required to be adopted in every state, including Virginia.

Because of Virginia’s principles-based approach, the Virginia Board of Accountancy (VBOA) will not need to seek statutory or regulatory changes to implement CPA Evolution. The VBOA did, however, submit feedback during NASBA’s open comment period. The VBOA pointed out several changes in the Model Rules that do not align with current Virginia regulations and the VBOA does not intend to make those proposed revisions at this time.

Get more

Everything you need to know about CPA Evolution is at evolutionofcpa.org, including information on the process, FAQs and much more.

Got questions?

Many CPA Evolution FAQs are available at evolutionofcpa.org, but here are a few:

What are some examples of the skills new CPAs will need?

NASBA and the AICPA have heard from stakeholders across the profession that new CPAs increasingly need deeper skills and knowledge in areas such as, but not limited to:

- Critical thinking

- Professional judgment/skepticism

- Problem solving

- Understanding of the business (including systems, controls and risk)

- Data management and analysis

- Performance of System and Organization Controls (SOC) engagements

How will CPA Evolution affect current CPA candidates?

Current candidates will still be able to sit for the current CPA Exam until the launch of the new Exam. A transition plan will be developed for candidates who have started, but not completed, the CPA Exam process by January 2024.

Does CPA Evolution address the 150-hour educational requirement?

CPA Evolution will change the CPA Exam to better meet today’s business demands, but there is no current proposal to alter the 150-hour educational requirement for CPA licensure.

Jill Edmonds is the VSCPA communications director and managing editor of Disclosures magazines, where she oversees all communications strategy, including print and social media.