By John Chennoor

In unique and challenging times, organizations should employ a forward-thinking strategy to help guide them securely into the future. Recognizing opportunities to increase cash flow is critical to future business success.

Utilizing the Credit for Increasing Research Activities [Research & Development (R&D) Tax Credit] to offset income tax OR for qualified small businesses to offset payroll taxes can generate instant cash flow. Yet it is often overlooked due to the mistaken belief that R&D Tax Credit studies can only be done in person. It is true that in “normal times,” conducting an R&D Tax Credit study would involve site visits, factory tours, and in-person whiteboarding sessions, however, as with many things over the past year, adapting to a virtual environment for an R&D study can be achieved.

By dedicating time and attention to the best practices outlined below, your organization can be successful and bring in additional cash flow at this challenging time.

The R&D tax credit: What to know

The R&D Tax Credit is a general business tax credit for companies that incur research and development costs in the United States. It has been around since 1981 as part of the Economic Recovery Tax Act (ERTA) and was made permanent by Congress in 2015.

Research activities that qualify for the credit must be undertaken for discovering information that is technological in nature and its application must be intended for use in developing a new or improved business component of the taxpayer. In addition, substantially all activities of the research must be elements of a process of experimentation related to a new or improved function, performance, reliability or quality.

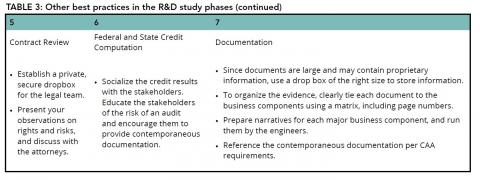

In addition to R&D Tax Credits at the federal level, many states also offer the credit. Most states follow federal regulations and IRS guidance on what constitutes a qualified research expenditure. However, some states, such as Virginia, Texas, Georgia, California and Connecticut, do not follow federal guidelines and have their own rules related to R&D. For example, Virginia provides a refundable R&D Tax Credit of up to $45,000; Virginia also offers a Major Research Credit that is not refundable. Your tax professional can help guide you on these criteria based on the states in which your R&D activities are conducted.

Understanding the terms

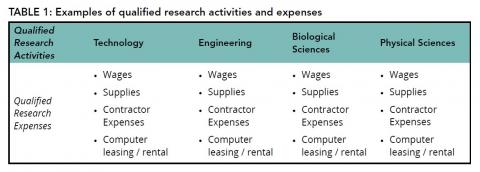

A qualified research activity is any activity that results in the creation of a new business component or the enhancement of an existing one (see Table 1). The IRS developed a four-part test as a framework for identifying qualified research activities that cover the 1.) permitted purpose of the business component; 2.) how technological the component is in nature; 3.) the elimination of uncertainty established during the development of the business component; and 4.) the process of experimentation that was utilized in the development of the business component.

Examples of activities that have the potential to qualify under the four-part test include software design, development and testing; hardware design, development and testing; engineering design, development and testing; or activities in biological sciences, physical sciences, and manufacturing of new/improved products.

Note: There are three additional tests for establishing the qualification of internal-use software (IUS) that are not included in this document.

Examples of activities that do NOT meet the requirements of a qualified research activity include reverse engineering an existing business component; research adapting an existing product or process to a particular customer’s need; research conducted outside the United States, Puerto Rico or any possession of the United States; and research related to social sciences, arts or humanities.

Qualified research expenses (QRE) are made up of in-house research expenses and contract research expenses. These include but are not limited to wages, supplies, contract research expenses, basic research expenses, and computer rental or lease expenses. Examples of non-qualified expenditures include travel expenses, patent filing expenses and shipping expenses.

Get leadership buy-in from the start

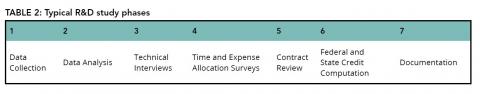

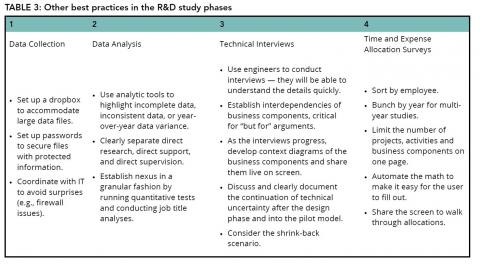

To establish how best to succeed in selling your executive team on an R&D study, it is key to first understand the various phases of the R&D project life cycle. A typical R&D study may be composed of the seven steps in Table 2.

Much of a study’s success can be attributed to bringing in the right parties, both external and internal to your organization, at the right time in the process.

The CEO, CFO, CTO and R&D department heads are balancing many different priorities. Present the potential benefits of an R&D study early to key leadership stakeholders to get them on board and ultimately make the project run more seamlessly. Though an R&D study takes time and initial investment, the cash tax savings can ultimately benefit the company’s bottom line. The organization may even be able to expand the budget for their R&D activities due to the savings gained, driving further efficiencies and innovation.

Assemble the right team

Using an R&D study team — a diverse team of engineers, attorneys and CPAs — allows for an efficient and effective study. Engineers on the study team will be able to understand technical concepts quickly and efficiently. Attorneys will be able to review complex contracts precisely and correctly. CPAs will be able to analyze and document your research and development activities to withstand IRS inquiries and bring tax savings.

A tax department head is usually the point of contact between the R&D study team and internal stakeholders including IT, HR, payroll, engineers and company leadership. From the launch of the study, present your approach to all stakeholders and describe the role of each participant. Detail the interconnection between what each participant provides and the R&D deliverables, so everyone is on the same page regarding their responsibilities.

Determine the technology to facilitate the study

Starting off the first virtual meeting with technical difficulties will not set the right tone for the project. Establish the technology the company will use, whether Zoom, Teams, WebEx or another technology, and stick to the same platform for each call. Test out the link in advance to make sure it is working. Since keeping everyone engaged on a video call can be difficult, we recommend the following to increase engagement:

- Turn on video: People remember more and understand concepts more quickly when they can see who they are talking to and get to know them as a person.

- Keep virtual presentations brief and visually appealing: Less text and more graphics will appeal to all, especially the engineers.

- Spend time on designing your spreadsheets: In a virtual environment, your product on screen is what communicates to your audience. Create spreadsheets that are easy to navigate (for example, sorting by employee and by year). To the extent possible, also make the time surveys and expense allocations visually appealing.

- Time your emails: Keep the project timeline in mind when sending an email. For example, avoid asking engineers to return surveys the day before a major product delivery deadline.

- Leverage a status dashboard: Dashboards can serve as a visual display of your progress on the study, making for strong virtual communication.

- When preparing audit-ready deliverables, create a Virtual Methodology Memo that clearly lays out the process you used.

Communicate status updates throughout the project

R&D studies tend to receive the least internal attention at the very beginning and the most attention in the event of an IRS audit when leadership is directly involved. To avoid this typical pattern, especially in a virtual setting, update the CEO, CFO and CTO frequently about the project status to help avoid surprises. By bringing leadership in again at the end of the study, they can see the results and the direct benefit to your organization. This can also be an opportunity to showcase the value of both the tax department and your trusted advisors.

In addition, we also recommend communicating with each department head how much they contributed to the tax credit. This data can be useful for future planning.

John Chennoor is a director in DHG’s tax consulting services, focusing on R&D tax consulting. John leads a dedicated team of R&D tax credit professionals for DHG, bringing to the table multidisciplinary experience in engineering, tax and management. Prior to joining DHG, he spent 16 years with a Big Four firm.

DHG’s R&D Tax Credit team provides comprehensive, tailored R&D tax credit studies to meet clients’ tax goals and provide analysis and documentation to withstand IRS inquiries. We would be happy to answer any questions you have on conducting R&D studies in a virtual environment.