By Peter B. Reilly CPA, CVA

Just five years ago, Councilor, Buchanan & Mitchell, PC (CBM) was a 38-person audit and tax practice with one office in Bethesda, Md. But after an aggressive approach to acquisition, we’ve transformed a somewhat vanilla firm into one of the area’s top 25 accounting firms (according to Washington Business Journal) that better serves its diverse client and employee base.

At 94 years young, CBM merged with a firm whose emphasis was in nonprofit auditing, which bolstered our nonprofit niche and audit practice and expanded our practice to 45 employees. Since then, we have acquired six other firms, doubled our service offerings and industry niches and now employ 103 professionals. We have thrived embracing diversity and inclusiveness and we listen to a wide spectrum of voices. Never wavering from our core values and assuring buy-in from our new members provides the foundation that keeps us strong and united.

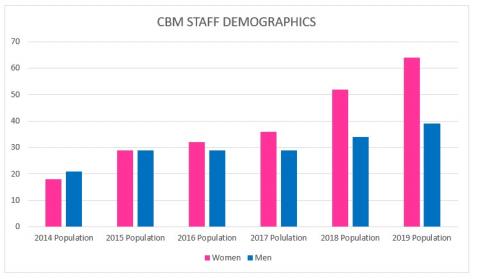

As the number of professionals at CBM evolves, the makeup of its professionals has shifted, allowing an emergence of talented female leaders. The current chair of CBM’s board, Patricia Drolet, was managing partner of Drolet & Associates, PLLC, a firm CBM merged with in 2014. She even won this year’s VSCPA 2020 Ruth Coles Harris Advancing Diversity & Inclusion Award.

If your firm is interested in merging, CBM has advice! Read on for dos and don’ts and to learn about the benefits CBM has enjoyed from our mergers.

Dos and Don’ts

Do: Review a firm’s profile. When a firm is targeted, its profile needs to be reviewed prior to a personal introduction. Basic information such as number of employees, salaries, types of services and client mix need to be understood. The same information requested in INSIDE Public Accounting or The Rosenberg Survey can be used as a guide. Should you find some interesting possibilities — like new industry or service niches, additional talent, bolstering of existing niches, etc. — then why not meet? Reviewing the profile of the targeted firm (i.e., prospect) with the candidates themselves is helpful and insightful. I have found prospects enjoy answering questions and elaborating about the information on the profile sheet, particularly when it pertains to themselves and their firms.

During the introductory meeting, the prospect’s leadership should demonstrate qualities such as concern for staff and clients. This shouldn’t be an afterthought. We have found that prospects who lead with a “What’s in it for me?” attitude usually aren’t a good fit. It’s also important to discuss their perceived benefits and obstacles to the merger.

Do: Craft a term sheet. It’s never too early to present a term sheet to the prospect. Provided the introductory meetings have gone well, then a working draft of the proposed terms can become the focus for future meetings. Each merger and acquisition where we have been involved could just as easily be described as business transitions or soft-landing retirements. CBM’s term sheets are one page and include: position, base compensation, eligibility for bonus, expected annual billings, expected annual charge hours, retirement (start date, percent of cash collected or annual salary and term of payment), committee involvement, firm equity and a list of benefits.

Don’t: Go it alone without lawyers and consultants. If you aren’t careful, legal costs can become a significant expense. We are at the point where we encourage the prospect to use a lawyer, but we will not absorb that cost as part of coming together. Also, spending time ironing out the details and putting those into a term sheet ahead of time will mean less time — and money — spent on legal. On two separate early mergers, we found investing in consultants to be money well spent. In one case, Terry Putney of Transition Advisors helped us save $30,000 on a tail policy that had been inserted by our insurance carrier, and Gary Adamson of Adamson Advisory pointed out how a certain deal made more sense as a retirement payout based on cash collections versus a percentage of average salary.

Do: Put on your project management hat. Once these management-level considerations have been satisfied, you will now face a considerable number of operational priorities. We use a detailed spreadsheet that assigns each task associated with the impending merger, including completion dates. We have found that assigning a point person from each firm assures smooth integration. The spreadsheet is broken down by client setup, employee setup, equipment assessment, training and marketing, among other operational areas. One person from each firm familiar with the area indicated on the spreadsheet should take responsibility and be held accountable for its completion. This can involve weekly meetings to better ensure that there are no surprises.

Do: Invest in infrastructure. Going deeper into operations inevitably means tackling infrastructure as well as the ability to integrate the merged team into your firm’s policies and procedures. This includes deploying technologies such as work-flow systems, a portal, scanning and artificial intelligence, among other items, to assist with efficiency. Members of the acquired firm must understand and agree to comply with your tax preparation, delivery process and report production process. In one of CBM’s earlier mergers, our team saw an advantage in combining the best of both firms when it came to formatting and processing financial statements. Even though we have been peer reviewed for the last 30 years, we acquiesced to the desires of the new team, the result of which was a change to all 350 financial statements, rather than having the acquired firm conform to already established and compliant reporting. In the end, our financial statement presentation is more robust and pleasing to the eye and gave both firms a chance to work together for the desired results.

Do: Respect client information and notification. As part of our due diligence in reviewing the prospect’s work papers, confidential client information may come to light. It is of paramount importance that confidentiality agreements are signed, including by those doing the review of the prospect’s work papers, not just the individual representative of the firm. Also, the American Institute of CPAs (AICPA) has issued guidance on transfer of client files in which the selling firm requests, in writing, the consent from its clients to transfer its files to the successor firm. All employees are provided a list of audit clients for review shortly after the merger to assure independence.

Don’t: Delay team transitions until the merger is complete. Integration must start immediately and should align with when the staff of the firm being acquired becomes aware of the transition. There is no need to wait for an official merger date. This is the process when team members of both firms learn about the impending transition and begin the process of joining together, becoming members of the new firm — one firm. Integration must remain a focus throughout the first two to three years. Some individuals acclimate immediately, while others are more of a slow pour. Constant attention must be paid to the integration process. Training sessions need to be scheduled and refresher courses made available. This is particularly important when new software is being introduced. Frankly, from past discussions with staff from both firms, there can never be enough training.

Mentors also play a vital role in easing fears and uncertainty. Also, mentors help in aligning firm and staff goals, including training and smooth assimilation. Open houses, happy hours and group meetings add to a feeling of inclusiveness. Communication must be open, happen often and always be a two-way street. If there is more than one office involved and the distance is not preclusive, then regular visits and exposure will add to the belief in one firm.

Don’t: Focus more on billing rates than operational efficiencies. One temptation when merging in a new firm is to overemphasize discrepancies in billing rates and salaries for similar positions across both practices. However, billing rates end up being less important than the acquiring firm’s workflow systems, which incorporate technology and operational procedures. Salaries can become similar by position within a year or two as long as billing rates are moved up accordingly. One of CBM’s early acquisitions paid employees significantly less than CBM did, which might at first glance have led to the assumption that that firm’s clients were used to lower billings. However, since CBM had invested in sophisticated technologies and developed strong internal processes, its workflow delivered efficiencies that led to billings competitive with those of the acquired firm. In addition, today our employees are paid a reasonable rate by position. Billing rates are important yes, but just as important — if not more so — is how the work gets done. Efficiencies and increased productivity can neuter the impact of billing differences.

Do: Give special consideration to integrating sole proprietors into the leadership team. Many sole proprietors are in business by themselves for a reason. Without a history of working with other stakeholders at a professional services firm, they can suddenly find themselves being asked to compromise as only one of several decision-making management team members.

They may, in fact, find the process quite challenging. Although this is certainly not true of all sole proprietors, they deserve some special consideration including due diligence beyond the numbers. A recent sole proprietor acquisition provided CBM with a significant number of attorneys to provide tax and consulting services. However, he struggled badly adapting to our basic policies and procedures during the integration process (which was costly for CBM), resulting in a parting of ways after only 20 months. While CBM retained several of his clients, the toll on our team was significant.

And remember: Change isn’t for everyone. After CBM acquired a smaller practice in 2014, the makeup of CBM’s leadership team noticeably changed, and professional considerations began to intersect with personal ones. The first change was the addition of two female partners (through acquisition), to a leadership team of five male partners. During 2015, we welcomed one of our four 30-something senior managers to partner, making three out of our eight partners under the age of 40 and the other three in their 30s on track to partner. The future was youthful and bright for CBM. And then all hell broke loose. One of the young partners, suffering from sole proprietor syndrome, left the firm to start his own nonprofit practice — with our clients. The terms of our employment contract were adhered to and a favorable financial agreement was consummated.

For family reasons, another partner needed to head back to New England, and then a senior manager next in line for partner left CBM for an outstanding job working for our largest client. All of this left us feeling like we surely weren’t in Kansas anymore. In fact, it felt more like standing on one of those Star Wars planets with Darth Vader’s Death Star bearing down on you. It’s true that once you double in size and add a diverse group of people to your organization, you are a different firm entirely. But in the end, we are who we are — and we like who we are.

Reap the benefits

Despite what might seem like living life at warp speed, the benefits of merging a practice (or several) into your own should make the journey worth it. Here are some of the benefits we’ve enjoyed as we’ve welcomed seven firms into the CBM fold over the past five years.

Diversity and inclusiveness: Believe in the power of diversity and inclusiveness! The addition of people will allow you to grow into it. The benefits to your firm from having differing perspectives cannot be overstated. Women, men, immigrants, minorities and LGBTQ individuals working together on the same team provides effective solutions. Culture is enhanced and your firm’s collective network is ever-expanding. Currently, CBM’s leadership stands at 46 percent female. The firm, as a whole, is 63 percent female, while minorities make up 23 percent.

Clear goals and expectations: Our growth has allowed us to establish a full-time professional development (PD) director. Our PD director’s performance is measured by the effectiveness of “Project Clear Path,” in which everyone is assigned a mentor and has a customized learning schedule that ensures that individual goals and CBM goals are aligned. The growth that has resulted from these mergers has, in no small way, provided CBM with the tools, education and resources — through Project Clear Path and through a dedicated manager — helping to create future leaders of CBM. Additionally, through CBM’s D-PATH, a part of Project Clear Path focusing on diversity and inclusiveness, our future leaders are assured to be diverse and reflective of our cultural surroundings with that assistance.

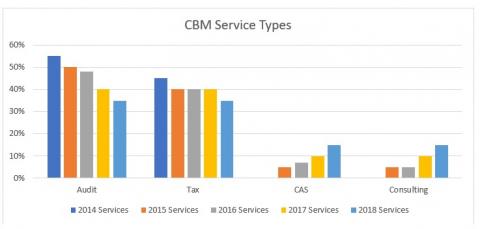

Service offerings: Five years ago, while we looked at things through a tax or audit approach, the real need for outsourced accounting services became apparent. We were lucky enough to have a senior manager with excellent technology skills take on the leadership role in directing our CAS effort. He designed our system and used a menu approach in offering CAS outsourcing. We have spread awareness through various marketing efforts, which in turn has generated significant organic growth. The addition of each new firm has provided cross-selling opportunities contributing to our significant growth of CAS.

Adding additional firms has also meant additional services. In addition to assisting in the growth of CAS, we have added financial planning, divorce litigation support (including collaborative), multi-state tax expertise and a separate investment management company. At the same time, our business valuation and forensic work have grown commensurately. Whereas in the past, CBM was a 55 percent audit / 45 percent tax firm, today we have a practice that is 35 percent audit, 35 percent tax, 15 percent CAS and 15 percent consulting.

For a long time, we managed our industry niches with marketing plans designed by Jean Caragher of Capstone Marketing. Our concentration was in automotive, nonprofit, construction/real-estate, individual/estates and trusts, wealth management and divorce litigation. We have established two additional industry niches that have the same reporting requirements and provide many cross-selling opportunities. Most recently, the addition of new professionals has allowed us to expand our professional services and government contractor niches. We also expanded into other areas requiring specialization and regulation, including ERISA engagements and SOC 1 and 2 audits, as well as collateral audits. Due to these expanded niches, we have been fortunate (again, due to our mergers) to have the above-mentioned Project Clear Path professional development program, which provides our staff with opportunities to expand and apply their knowledge to our varying practice areas. The goal is that each professional will ultimately choose to specialize in an area that meets their aspirations.

Marketing: Marketing plays a critical role throughout the merger process, from presenting the target firm’s profile to your partner group, to ordering business cards with current addresses and contact information. Our client database, prospect database and national and local media receive our press releases. Press releases introduce our new firm to the community, including our new niches or enhanced services. We have issued press releases when the addition of new space is procured, including recognition of those involved in the acquiring, designing and building of the new space.

We have also placed an emphasis on our new spaces for being recognized as state-of-the-art training facilities. As a result of our client’s and prospect’s interests in financial planning and the changes to the tax law and new nonprofit accounting standards, our training facilities have remained filled with clients and prospects. E-newsletters are regularly distributed highlighting our industry and services niches, including announcements about changes within the firm. Of course, our marketing director’s expansion of our involvement with social media and its integration with our website has grown past my abilities to meaningfully explain.

Partner and director accountability: As CBM’s service offerings and industry niche concentrations have grown, so has the opportunity for our professionals to manage and report on their respective business units. Their responsibilities as a director of a business unit includes management, professional development, strategy, marketing, communications and reporting. Each director is provided data and statistics on the niche monthly, and they report to the partner group on a quarterly basis. Firm management is one of the components in determining partner and director compensation, so being appointed to serve as a niche director provides additional growth and financial incentives. Also, our marketing, professional development and HR directors report to the partner group in a similar fashion. This provides both partners and directors the opportunity to demonstrate skill sets that go beyond outstanding client service.

Cementing the deal

There is immediate payroll coverage needed for the newly acquired employees, so we ask for a contribution of the predecessor firm’s WIP and Accounts Receivable to cover about two to three months of payroll. The amount of money collected above a set amount — their contribution to CBM — will be returned to the acquired firm once collected. The acquired firm can keep their furniture and computer equipment (realistically, you will just be replacing it sooner than your best budget estimates). Call it a merger, an acquisition, a marriage, a two-step process — whatever you want. In the end, the merger is a retirement arrangement. If an individual is later in years, then consider a retirement payout based on a percentage of cash collections. Younger partners will receive an eventual retirement based on the average of the last five years’ salary. Hire all non-partner employees with your existing employee contract.

Remember that, ultimately, it’s all about your collective staff and your clients. You can’t predict what your new normal will be like, but since you will never compromise your core values, it will be fine. In all likelihood, better than fine. Through growth we are diversified across services, industries, people and personalities — and we’re all the better for it.

Our firm has peaked at 100 people so that we can remain “small.” Small in the sense that we continue to provide personal service as our clients’ needs change, supplying the demand of multiple services. Today we meet our client’s diverse needs in a smarter way.

Peter B. Reilly, CPA, CVA, is president and managing partner of Councilor, Buchanan & Mitchell, PC, (CBM) in Bethesda, Md. He has 40 years of audit and tax experience in planning and supervising engagements in the construction/real estate, automotive and nonprofit ndustries. Pete has presented on this topic for industry groups including the American Institute of CPAs (AICPA), Rainmaker Companies, Upstream Academy and more. Email him, find him on LinkedIn, or follow CBM on Twitter at @cbmcpa.